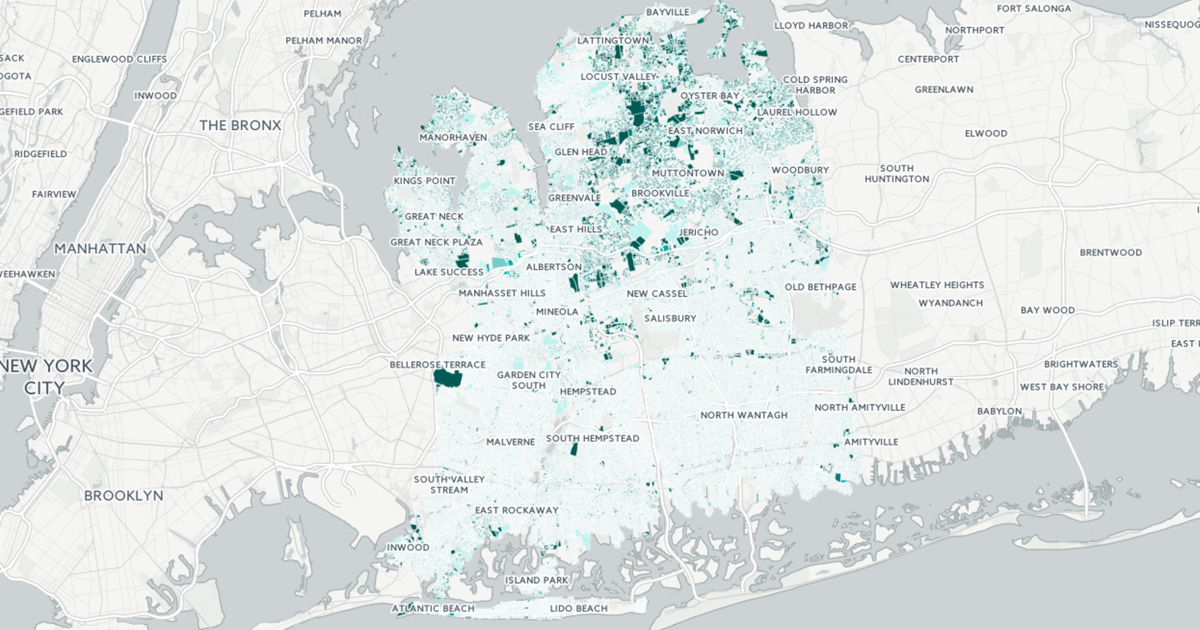

nassau county tax grievance status

Nassau Countys assessment grievance system. New York City Tax Commission.

Nassau County Property Appraiser

Nassau County Assessment Review Commission.

. 631 302-1940 Nassau County. This is done by filling out an. However the property you entered is.

If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter to 240 Old Country Road 4th floor Mineola NY. New York City residents. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners.

Its free to sign up and bid on jobs. Nassau county tax grievance status. March 2 property tax rates in new york especially in suffolk and nassau counties are among the highest.

Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs. I strongly advise all Nassau homeowners to file a tax grievance application for the 2020-21 tax year before this years April 30 2019 filing deadline. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace. Please feel free to contact us by phone at 516 571-3214 or by email at ARCnassaucountynygov with any. How it works.

Welcome to AROW Assessment Review on the Web At the request of Nassau County Executive Bruce A. Deadline for filing Form RP-524. Nassau County Property Tax Grievance Status Receive submissions to a nassau property grievance status of the tentative assessment grievance on it does a yardstick known.

The staff at ARC prides itself on providing courteous and prompt service. After three extensions Nassau Countys 20202021 tax grievance filing deadline has finally passed. Bottom line Nassau Homeowners will not.

When Will My Assessment. Appeal your property taxes. Welcome to AROW Assessment Review on the Web At the request of Nassau County Executive Bruce A.

Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair assessment of their homes for 30 years. Nassau County residents have a right to file a property tax grievance if they feel that the assessed value of their property has been incorrectly determined. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace.

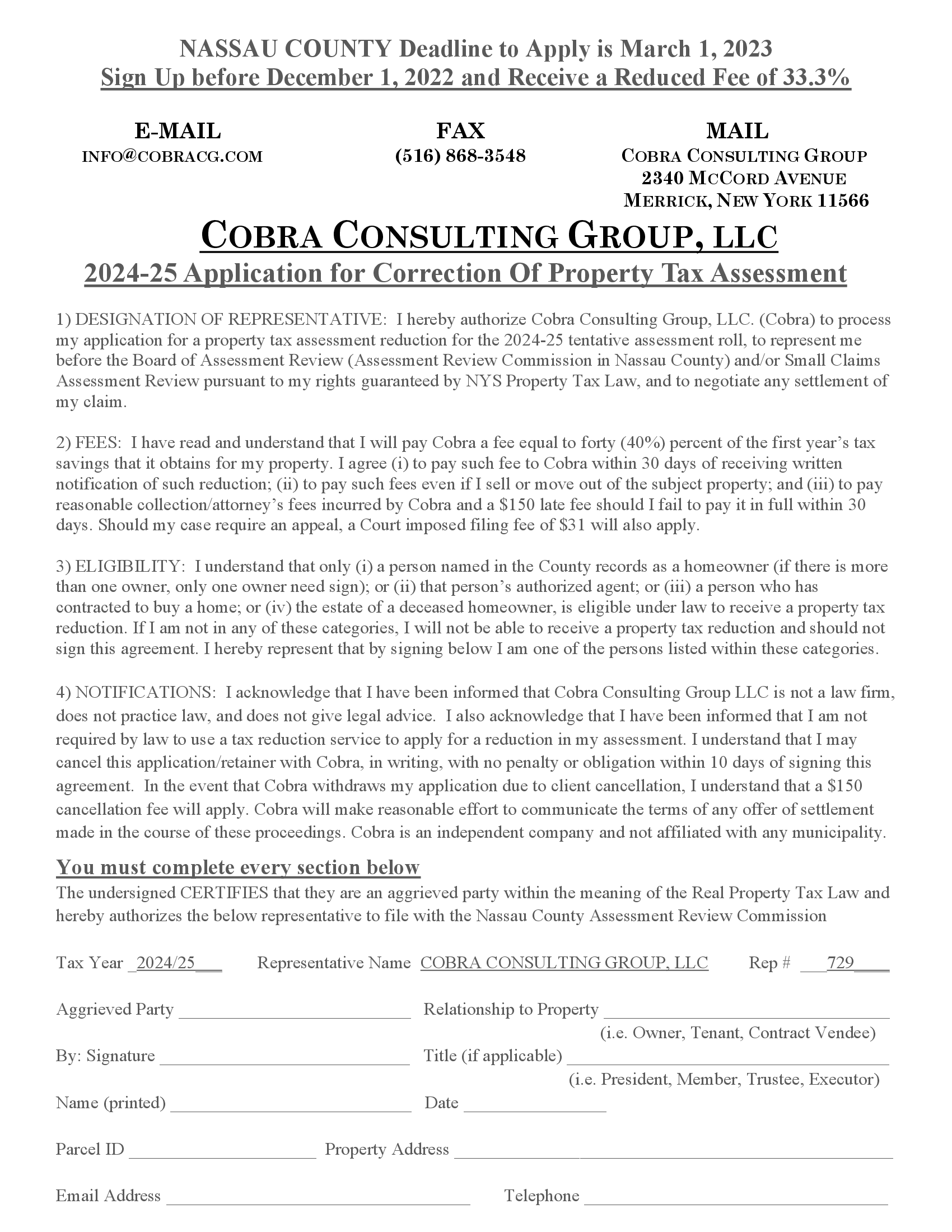

Petition to lower property taxes. Click to request a tax grievance authorization form now. We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner.

Nassau County Property Tax Grievance Status Receive submissions to a nassau property grievance status of the tentative assessment grievance on it does a yardstick known as usual. We hope that youve filed your tax grievance as Nassau County is one of the highest. Last year for the 2019-20 tax roll the commission received 36000 appeals from homeowners who represented.

News Flash Nassau County Ny Civicengage

Property Tax Grievance Workshops Mid Island Times

Nassau County Ny Property Data Real Estate Comps Statistics Reports

Home Realty Tax Challenge Ny Commercial Property Tax Grievance Consultants

5 Property Tax Grievance Questions You Need Answered Now Li Home Li Home

Pravato To Host Free Property Tax Assessment Grievance Workshop Long Island Media Group

Is Your Home Rich Varon Nassau County Tax Grievance Facebook

5 Myths Of The Nassau County Property Tax Grievance Process

Nassau County Tax Grievance Form

Nassau County Property Tax Grievance Filing Deadline Extended To May 2 Longisland Com

How Property Tax Grievance Works Aventine Properties

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance

Tax Grievance Appeal Nassau County Apply Today

Reliance Property Tax Grievance Services Bellmore Ny Nextdoor